Brand and digital marketing

Data analytics and insights

Unleashing success for niche fragrance brands within evolving market dynamics: Three key pillars of change in 2024

September 23 2024

The niche luxury perfume market was one of the strongest growth sectors of 2023. For C-suite leaders and private equity investors, the question is no longer about the potential of this sector but how to effectively harness its growth.

In the article below, we uncover:

- How the growing niche fragrance sector, mirroring the broader luxury industry, is driven by younger consumer segments

- How private equity responded to this growth market in 2023

- How the niche fragrance market demonstrates three pillars of change to meet evolving consumer preferences: Investing in digital transformation, Data-driven product offerings, and Building brand affinity through bridging phygital experiences.

The fledgeling luxury consumer wears niche fragrance

The niche fragrance sector, mirroring the broader luxury industry, is witnessing a remarkable transformation driven by the preferences and spending habits of younger consumers.

Younger consumers are stepping into the luxury market much earlier than other generations ever have – investing in items with more perceived longevity and value. Perfumes are a clear gateway to this luxury basket, having a lower price point than other luxury categories.

This culture is evident across social media platforms like TikTok where there is a clear indication of growing consumer interest in the niche perfume sector. As of March 2024, #perfumetok has accumulated 12.1B views from 783.8K videos in the platform a +130% increase from previous year (PY), with #nicheperfumery garnering 281.8M views from 27.7K user videos +275% increase vs PY. (Singulier Analysis, Apr 2023-2024) This demographic shift is redefining the essence of luxury and prompting brands to adapt their strategies to cater to this emerging market segment.

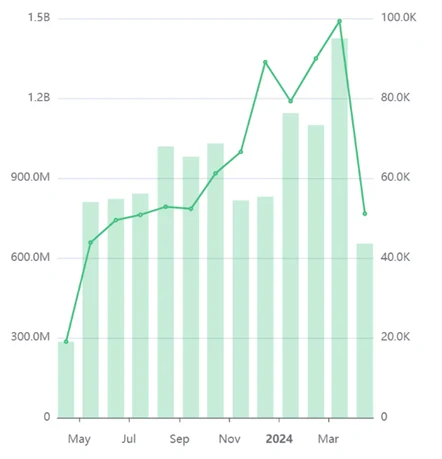

#Perfumetiktok climbs in viewer impressions, April 2023-2024, Singulier analysis

“In the luxury fragrance market, the rise of younger consumer segments presents both an opportunity and a challenge.” says Mathieu Ferel, co-founder and partner of Singulier. “It’s clear that brands need to fundamentally reshape how they engage with their audience. Through our work with luxury perfume brands, we have discovered that success lies in a deep, data-driven understanding of these new consumer profiles, coupled with a customer-centric approach to brand, product, and distribution strategies. Embracing this change isn’t just about survival; it’s a pivotal moment for the industry to redefine luxury and forge lasting relationships with the next generation of consumers.”

mathieu ferel, partner, singulier

Private equity sets big growth ambitions in niche fragrance brands

The year 2023 marked a significant inflexion point, with private equity firms increasingly recognising and investing in the potential of the niche fragrance market. This influx of capital and strategic expertise has been instrumental in propelling growth, as well as in facilitating the shift towards more customer-centric business models.

In 2023, Creed became part of the Kering portfolio and Advent International took control of Parfums de Marly. In the preceding year, Byredo found a home with PUIG, and Diptyque has long been under the ownership of Manzanita Capital. An increasing trend to drive growth is to transition from a wholesale-centric model to a multifaceted distribution approach with a pronounced focus on direct-to-consumer (DTC) channels.

The strategic investments by private equity firms in the niche fragrance sector, marked by notable acquisitions in 2023, underscore a pivotal shift in the industry’s dynamics. For PE investors and C-suite executives in luxury fragrance, this trend signifies a crucial opportunity for value creation and future-proofing.

Our key guidance to clients aiming to maximise returns in this burgeoning segment has been around three key pillars of change - Investing in digital transformation, Data-driven product offerings, and Building brand affinity through bridging phygital experiences.

Pillar 1: Investing in Omnichannel Digital Transformation

Market leaders are transitioning from wholesale to omnichannel. Fragrance brands initially relied on wholesalers for visibility, which limited their control over the brand experience and access to customer data. This challenge is compounded by recent privacy updates by tech giants that emphasise the need for brands to gather first-party data through DTC channels.

However, despite the benefits, many luxury brands overlook the transformative potential of customer knowledge and data in enhancing their business operations. Known for personalised experiences, traditional luxury brands often lack data intelligence. By investing in analytics, luxury brands can leverage customer insights for targeted up-selling and cross-selling.

Parfum de Marly’s transition from wholesale to multichannel, which involved establishing physical stores and enhancing their e-commerce, has been instrumental to their success with younger markets. This allowed them to blend online and in-store experiences, gaining deeper customer insights and brand control.

Pillar 2: Diversified Product Offerings Based on Consumer Intelligence

In the competitive DTC sales landscape, building strong brand affinity is crucial for standing out against wholesalers and third-party retailers known for fast deliveries and loyalty programmes.

Brands should use consumer data to diversify offerings and tailor them to various preferences and journeys. Limited edition products and discovery kits, informed by data insights, can be effective sales drivers across luxury perfume brands, encouraging frequent purchases and personalised experiences.

Brand preference extends beyond products. Data-driven rewards like personalised services, exclusive experiences, and Gifts With Purchase (GWP) enhance the customer experience. These strategies, alongside data-driven loyalty programmes, strengthen distribution efforts in department stores and wholesalers.

Case in point, Byredo has strengthened its DTC value proposition with unique products and limited editions, bolstering customer retention. Their use of consumer intelligence, alongside brand storytelling and enhanced online interactions, underscores the significance of data and digital engagement in today’s market.

Diptyque Paris, Store at Saint-Honoré

Pillar 3: Building Brand Affinity by Going Phygital

To succeed, luxury perfume brands must meet their audiences wherever they are, sharing their stories and values seamlessly across digital and physical channels. Platforms like TikTok and YouTube provide avenues for dynamic storytelling, reaching a digitally native audience and fostering direct engagement. This amplifies brand visibility and cultivates deeper consumer connections.

At the same time, physical spaces create unique, immersive experiences that draw customers into the brand universe. Diptyque exemplifies this approach with its new La Maison Diptyque stores, designed to bring the brand’s world to life through sensory-rich environments that complement their enhanced website experience and active social media presence. These stores serve as extensions of the brand, offering customers an opportunity to engage with its heritage, craftsmanship, and creativity firsthand.

By integrating digital and physical experiences, luxury brands can create a lasting impact and build stronger relationships with their customers. Digital channels provide reach and engagement, while physical stores deliver authenticity and memorable encounters. This strategic blend of heritage and innovation sets successful brands apart.

What Singulier can do for you

At Singulier, we specialise in crafting bespoke strategies that resonate with the unique needs of luxury perfume brands. Our team of experts is adept at navigating the complexities of the fragrance industry, leveraging data-driven insights to tailor solutions that enhance brand affinity, customer engagement, and market positioning.

Whether it is enhancing your digital presence, establishing captivating physical stores, or building a customer-centric approach to your business model, our experts in Singulier can help you build a luxury fragrance brand that not only captivates but also endures.

Speak to our experts

Partner at Singulier

[email protected]

GHITA FIZAZI

Expert Partner, Data Analytics and Insights